Divestment

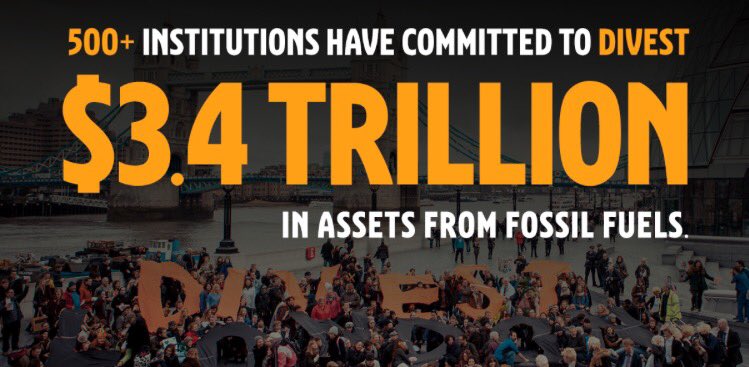

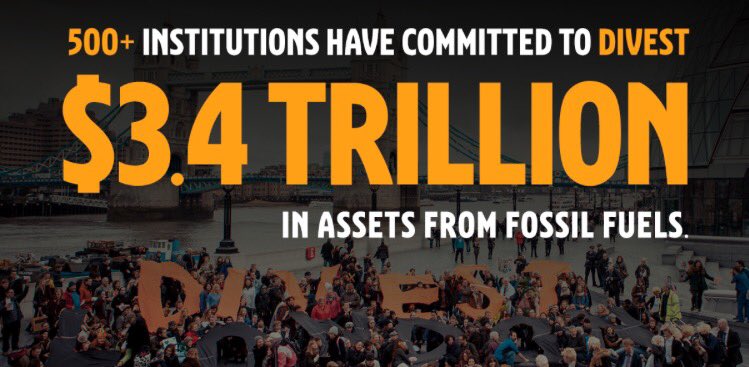

Fossil fuel divestment is a movement to push educational and religious institutions, governments, and other organizations that serve the public good to divest from fossil fuels. Divestment is the opposite of investment – it refers to getting rid of stocks, bonds, or investment funds for ethical reasons. The movement to divest from fossil fuels was born at U.S. Colleges and Universities inspired by successful divestment campaigns of the past – most notably around the issue of South African Apartheid in the mid-1980s. At the end of 2015 more than 500 organizations had committed to divest $3.4 trillion in assets from fossil fuels.

Fossil fuel divestment campaigns are taking place around the world with efforts coordinated by an international network called Fossil Free. Most campaigns ask institutions to immediately freeze any new investments in fossil fuel companies and divest from direct ownership and any commingled funds that include fossil fuel public equities and corporate bonds within 5 years.

Reinvestment

The next step for institutions divesting from fossil fuels is to make decisions about reinvestment. The Forum For Sustainable and Responsible Investment (US/SFI) offers a concise overview of the asset classes where reinvestment is possible for retail, accredited and institutional investors concerned about climate change risks and progress towards a low carbon economy. US/SFI also offers a series of guides for sustainable and responsible investment with various foci, including to curb climate change. The Campus Climate Challenge has also created a guide to reinvestment for College and Universities.

Popular Articles

Resources

Explore this list of organizations and websites or visit Go Fossil Free’s resources page for more information about fossil fuel divestment and reinvestment.

Go Fossil Free

Go Fossil Free is project of 350.org that coordinates an international network of campaigns calling on educational and religions institutions, governments, and other organizations that serve the public good to freeze any new investments in fossil fuel companies and divest from direct ownership and commingled funds that include fossil fuel public equities and corporate bonds.

Go Fossil Free is project of 350.org that coordinates an international network of campaigns calling on educational and religions institutions, governments, and other organizations that serve the public good to freeze any new investments in fossil fuel companies and divest from direct ownership and commingled funds that include fossil fuel public equities and corporate bonds.

News - The Guardian

The Guardian has ongoing coverage of fossil fuel divestment news.

The Guardian has ongoing coverage of fossil fuel divestment news.

Fossil Fuel Student Divestment Network

The Fossil Fuel Student Divestment Network supports a growing student-led, university-centered divestment movement.

Influence Map

Influence Map is neutral and independent UK-based non-profit whose remit is to map, analyze and score the extent to which corporations are influencing climate policy and legislation worldwide.

Carbon Tracker Initiative

Carbon Tracker is a not for profit financial think tank aimed at enabling a climate secure global energy market by aligning capital market actions with climate reality.

Carbon Tracker is a not for profit financial think tank aimed at enabling a climate secure global energy market by aligning capital market actions with climate reality.

Unburnable carbon 2013: Wasted capital and stranded assets

Research from Carbon Tracker calls for regulators, governments and investors to re-evaluate energy business models against carbon budgets, to prevent a $6trillion carbon bubble in the next decade. This report revealed that fossil fuel reserves already far exceed the carbon budget to avoid global warming of 2°C, but in spite of this, investors spent $674billion last year to find and develop new potentially stranded assets.

Beyond Fossil Fuels: The Investment Case for Fossil Fuel Divestment

This report from Impax Asset Management Group explains why investors should consider reorienting their portfolios towards low carbon energy by replacing fossil fuel stocks with energy efficiency and renewable energy investments, thereby retaining exposure to the energy sector while reducing the risks posed by the fossil fuel sector.

The Carbon Underground 2015

The Carbon Underground 2015 identifies the top 100 public coal companies globally and the top 100 public oil and gas companies globally, ranked by the potential carbon emissions content of their reported reserves. The reserves of these companies total 555 gigatons (Gt) of potential CO2 emissions, almost five times more than can be burned for the world to have an 80% chance of limiting global temperature rise to 2°C (3.6° F).

UNEP FI Investor Briefing

Through this Investor Briefing, the United Nations Environment Programme Finance Initiative provides a case for why and how investors and their service providers should start measuring, disclosing and reducing the GHG emissions associated with their investments and investment portfolios.

This resource page is a work in progress. Have suggestions or comments? Please contact us.

Go Fossil Free

Go Fossil Free The Guardian has

The Guardian has